Just like owner's title insurance protects the buyer, lender's title insurance protects the bank or financial institution that issued the buyer a mortgage. » MORE: What is title insurance, and why do you need it? However, it's always possible to negotiate who pays what. In Connecticut, it's more common for the buyer to pay for owner's title insurance. It will pay for any legal fees if mistakes are found - or potentially even reimburse the value of the home. Owner's title insurance protects the buyer if there's a problem with the property title. In Connecticut, buyers and sellers usually pay for their own title company or closing agent, but don't expect this for every sale. To ensure there are no claims or liens on your home, your settlement agent will complete a title search.

When you sell your home, you have to transfer legal ownership of the property to the buyer. Title fees cover the costs of the title search and title transfer. » MORE: See how Clever can help match you with the perfect agent Clever can help by matching you with a top agent in your area who can score you a great deal. If you want to get the most out of negotiations, you'll need an experienced agent who has your best interests in mind. While closing costs will always have to be paid, your real estate agent can often negotiate who pays them - you or the buyer. These closing costs are only an estimate. Optional costs for sellers include buyer incentives or pro-rated property taxes.īuyers, on the other hand, pay for things like mortgage, appraisal, and inspection fees. In Connecticut, sellers typically pay for the title and closing service fees, transfer taxes, attorney fees, and recording fees at closing.

The most commonly used are conveyances between spouses, conveyance due to foreclosure, and conveyance for little or no consideration.Are you a top realtor? Join Clever’s networkĭo you want to close more loans? Join Clever's partnership programīuyers and sellers each pay unique closing costs to finalize a home sale. There are 22 exceptions that are noted on the back of the instructions to the return. Are there any exceptions to the Connecticut Real Estate Conveyance Tax? If a home sells for $200,000.00, the Seller will have to pay $1,500.00 to the State of Connecticut, and $1,000.00 to the Town. 0050 of every dollar to the local municipality (that’s 1/2 of 1%).

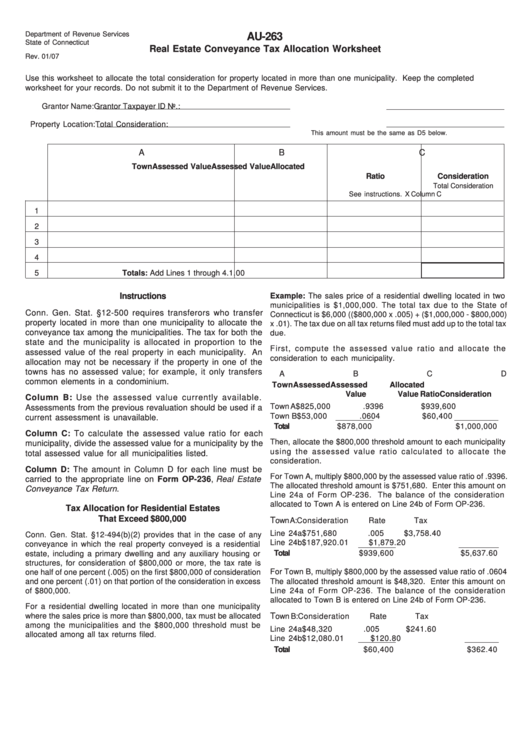

0075 of every dollar to the State (thts 3/4 of 1%) and. In Connecticut, the real estate conveyance tax is. The amount of the conveyance tax is dependent on the value of the real estate property being conveyed. How much is the real estate conveyance tax in Connecticut? A fillable online version is available here. You must also present a completed and signed OP-236 – Connecticut Real Estate Conveyance Tax Return. The real estate conveyance tax MUST be paid to the Town Clerk (note: not the tax collector) at the time that the Deed transferring title is recorded on the land records. The conveyance tax is paid BOTH to the State of Connecticut as well as to the municipality in which the property is located. However, there are some clever Sellers that put the burden of paying the conveyance tax on the Buyer in the real estate purchase and sale contract. A real estate conveyance tax is a tax paid by the “Transferor” in a real estate transaction, typically this is a Seller.

0 kommentar(er)

0 kommentar(er)